Unknown Facts About Unicorn Financial Services

Wiki Article

Some Ideas on Mortgage Brokers Melbourne You Should Know

Table of ContentsExcitement About Melbourne BrokerGetting The Refinance Melbourne To WorkThe Mortgage Broker Melbourne StatementsGet This Report on Unicorn Financial ServicesWhat Does Melbourne Mortgage Brokers Mean?

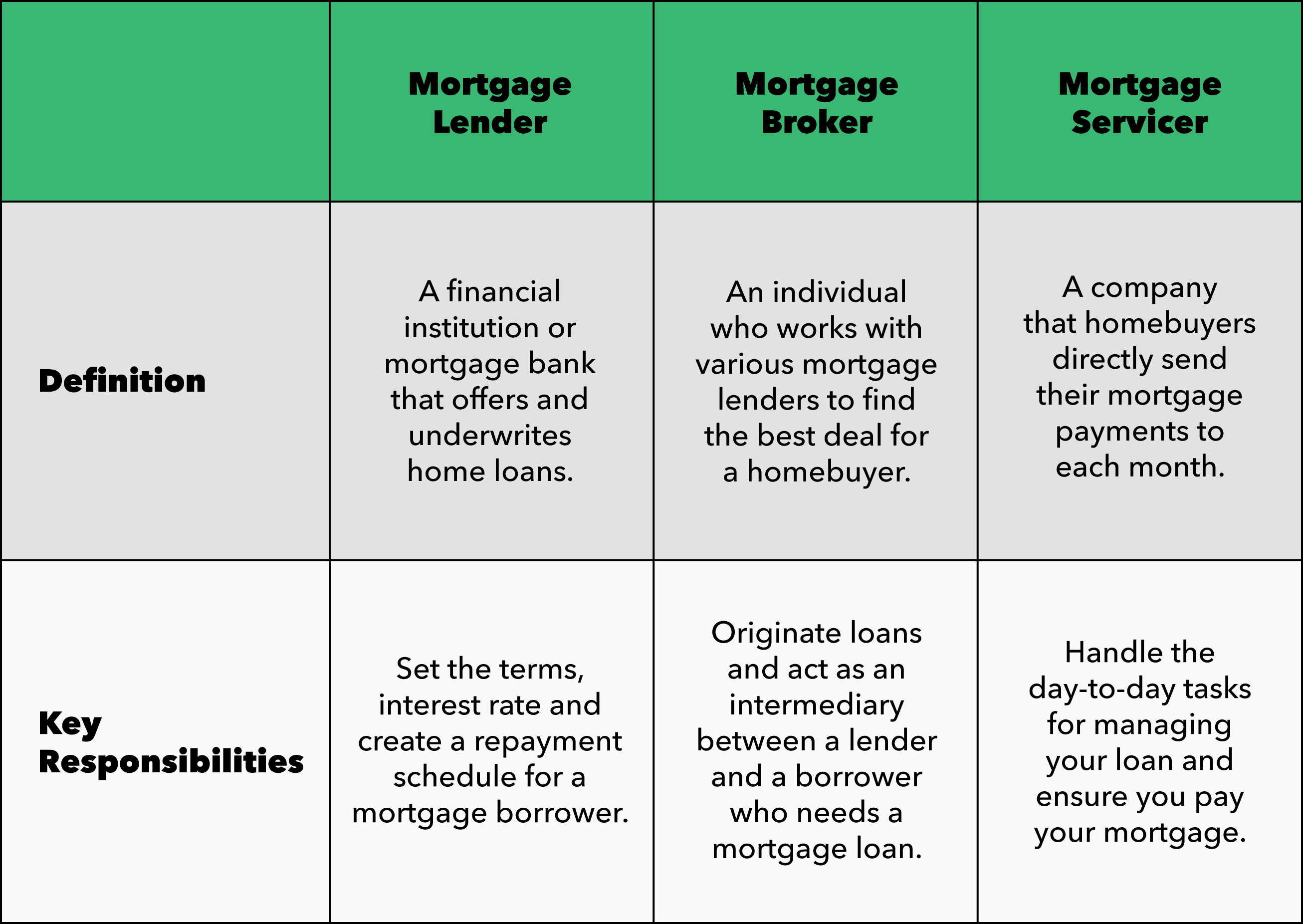

A professional home loan broker stems, works out, and refines household and business home loan fundings in behalf of the customer. Below is a 6 factor overview to the solutions you ought to be used and also the expectations you need to have of a competent mortgage broker: A home mortgage broker provides a large range of home loan from a number of different lenders.A mortgage broker represents your interests instead than the passions of a financing organization. They should act not only as your agent, however as an educated consultant and also trouble solver. With accessibility to a broad range of home mortgage items, a broker has the ability to offer you the best worth in terms of rate of interest rate, settlement amounts, as well as funding products (melbourne mortgage brokers).

Lots of situations require even more than the simple use of a 30 year, 15 year, or adjustable rate home mortgage (ARM), so innovative mortgage approaches as well as innovative services are the benefit of collaborating with a seasoned mortgage broker (https://baileysbizlistings.com/mortgage-broker/unicorn-financial-services-springvale-victoria/). A home loan broker navigates the customer with any kind of situation, taking care of the process as well as smoothing any bumps in the roadway along the road.

Debtors who find they need bigger car loans than their financial institution will certainly accept also gain from a broker's expertise and also capability to efficiently get financing. With a home mortgage broker, you just need one application, instead of finishing forms for each private loan provider. Your home loan broker can offer an official comparison of any type of financings suggested, assisting you to the information that precisely depicts price distinctions, with present rates, points, as well as closing prices for each lending mirrored.

Examine This Report on Loan Broker Melbourne

A respectable home mortgage broker will certainly divulge how they are paid for their solutions, along with detail the complete prices for the car loan. Customized solution is the differentiating aspect when picking a home loan broker. You need to expect your home mortgage broker to help smooth the means, be readily available to you, and suggest you throughout the closing procedure.:max_bytes(150000):strip_icc()/dotdash-loan-officer-vs-mortgage-broker-5214354-Final-4c8f2e5a070a434fafcb2afa1dbe9e1b.jpg)

Collaborating with a mortgage broker can possibly conserve you time, initiative, and also money. A home loan broker might have far better and much more accessibility to loan providers than you have. However, a broker's interests might not be aligned with your very own - Unicorn Financial Services. You might obtain a far better deal on a financing by dealing directly with loan providers.

The smart Trick of Unicorn Financial Services That Nobody is Talking About

A home mortgage broker executes as intermediator for a banks that offers fundings that are safeguarded with actual estate and also people that wish to acquire property and require a finance to do so. The home mortgage broker deals with both borrower and lender to get the consumer authorized for the financing.A mortgage broker normally works with lots of different lenders as well as can use a range of car loan alternatives to the customer. A customer doesn't have to function with a home mortgage broker.

A loan provider can be a financial institution, a debt union, or various other financial enterprise. Possible home buyers can go straight to any kind of lending institution for a lending. While a mortgage broker isn't required to facilitate the transaction, some lending institutions may only overcome home loan brokers. So if the lending institution you favor is among those, you'll need to make use of a home mortgage broker.

They're the individual that you'll handle if you come close to a lender for a financing. The financing police officer can help a customer recognize and also select from the fundings supplied by the loan provider. They'll answer all inquiries, aid a borrower obtain pre-qualified for a financing, and aid with the application procedure.

The Ultimate Guide To Mortgage Broker Melbourne

Home loan brokers do not provide the funds for car loans or approve financing applications. They help people looking for home mortgage to find a loan provider that can money their house purchase. Start by making certain you comprehend what a mortgage broker does. Ask friends, loved ones, and company acquaintances for references. Have a look at online reviews and check for issues.Ask about their experience, the accurate help that they'll give, the fees they bill, as well as how they're paid (by loan provider or consumer). Ask whether they can help you in certain, given your details economic conditions.

Faced with the problem of whether or not to make use of a home mortgage broker or a lender from a financial institution? Well, we are right here to inform you, don't run to the financial institution! It's nothing try this site individual. We like banksfor things like saving and spending cash. When you are aiming to get a residence, however, there are 4 crucial elements that home loan brokers can provide you that the lenders at the bank just can't.

Personal touch appears to be progressively much less usual in today's culture, yet it should not be. None of us live the exact same life as another, so customization is very important! Purchasing a house is type of a huge bargain! At Eagle Home mortgage Business, personal touch is something we satisfaction ourselves in. You reach deal with one of our representatives directly, who has years of experience as well as can respond to any type of questions you could have.

The Refinance Broker Melbourne Diaries

Financial institutions, on the various other hand, have a minimal routine. Their hrs of procedure are usually while you're currently at the office. That has the time for that? Not to discuss, every vacation is a national holiday. Obtain the personal touch you are entitled to with a mortgage broker that cares! The adaptability a mortgage broker can offer you is simply an additional reason to stay clear of going to the financial institution.

Report this wiki page